In Lexington, Airbnb listings eclipse housing inventory by 50%: Does a crisis loom?

Lexington, KY – The short-term rental market in Lexington, Kentucky, is not only showing signs of strain but also exhibits a concerning ratio of short-term rental listings to available housing inventory, mirroring concerns raised by housing consultant Nick Gerli in a viral tweet thread about the Airbnb market in some American cities like Austin, Texas.

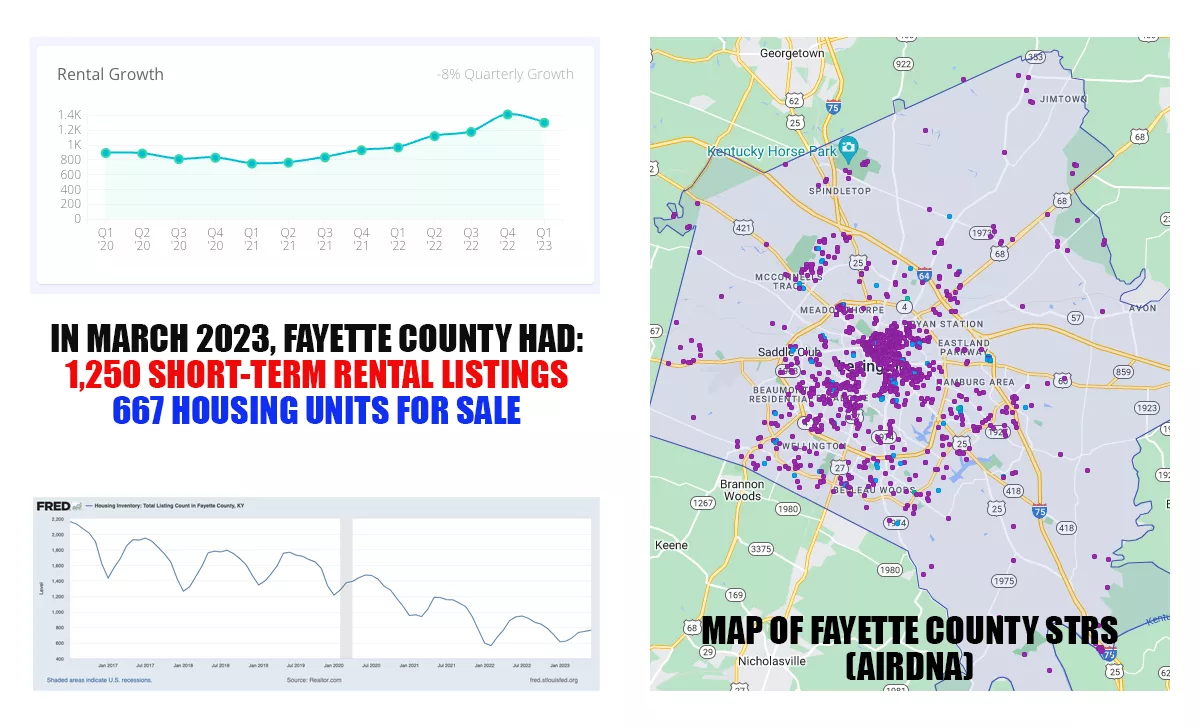

According to data from AirDNA, Lexington has seen a 57% occupancy rate in the current month, only slightly below Austin’s 61%. While Austin recently experienced a surge in short-term rental listings, as evidenced by Gerli’s tweet thread, Lexington too, has a notable presence in the short-term rental market. There are 1,250 active rentals in Lexington, with an overwhelming 93% of these being entire home rentals.

Nick Gerli, CEO of Reventure Consulting, warned of an “explosion” of supply in some cities, where short-term rental (STR) listings significantly increased in a short period. In Austin, the supply of short-term rental listings jumped from under 8,000 to more than 12,000 in just a few years. Similarly, Lexington’s market grew from 893 rentals in early 2020 to a peak of 1,410 units in the last quarter of 2022. While Lexington has a smaller market, the saturation of entire home rentals could indicate a similar trend on a different scale.

Another critical point to consider is how this impacts the availability of housing for residents. Gerli’s data indicated that in some regions, the number of Airbnbs is significantly higher than the number of homes for sale. In Lexington, the influx of entire home rentals might also be removing potential housing from the market, and if owners begin to sell or convert these properties into long-term rentals, it could disrupt the market further. Despite having 1,250 short-term rental units, Fayette County housing inventory stood at only 764 units in June, according to Federal Reserve data. A July 1 search for Fayette County listings on Realtor.com yielded similar results: 813 total listings.

The average daily rate for rentals in Lexington is $184, with an average monthly revenue of $2,274. However, as Gerli pointed out for other cities, an oversupply of Airbnb listings could lead to lower revenues for individual owners. In the case of Lexington, this oversupply may cause prices to be driven down as owners compete for guests.

Furthermore, Gerli emphasized the potential of a wave of forced selling from Airbnb owners later this year in the areas hit hardest by the revenue collapse. If Lexington follows a similar pattern as Austin, this could also impact the local real estate market.

Property managers in Lexington, like Kentucky Life Property Management and Buro Home, have listings in the double digits and have received high ratings. However, the future sustainability of their revenues and growth could be questioned in light of Gerli’s observations.

While Lexington’s short-term rental market is not as large as Austin’s, there are similar patterns and concerns regarding occupancy rates, revenues, and the possible oversaturation of short-term rentals. Lexington’s stakeholders and property owners should be vigilant and consider the potential implications of the trends and warnings highlighted by experts like Nick Gerli. It might be the time for regulatory bodies to evaluate the short-term rental market’s impact on housing availability and take measures to balance tourism and residential needs, such as a moratorium on new short-term rentals.

Recommended Posts

Kamala Harris needs a VP candidate. Could a governor fit the bill?

Fri, July 26, 2024

After cyber-attack on Jefferson County Clerk, Fayette counterpart discusses precautions

Fri, July 26, 2024

An eastern Kentucky animal shelter is swelling this summer

Fri, July 26, 2024