Federal Reserve Director’s former firm secured $11M in city Affordable Housing funds despite past scrutiny

by Paul Oliva, The Lexington Times

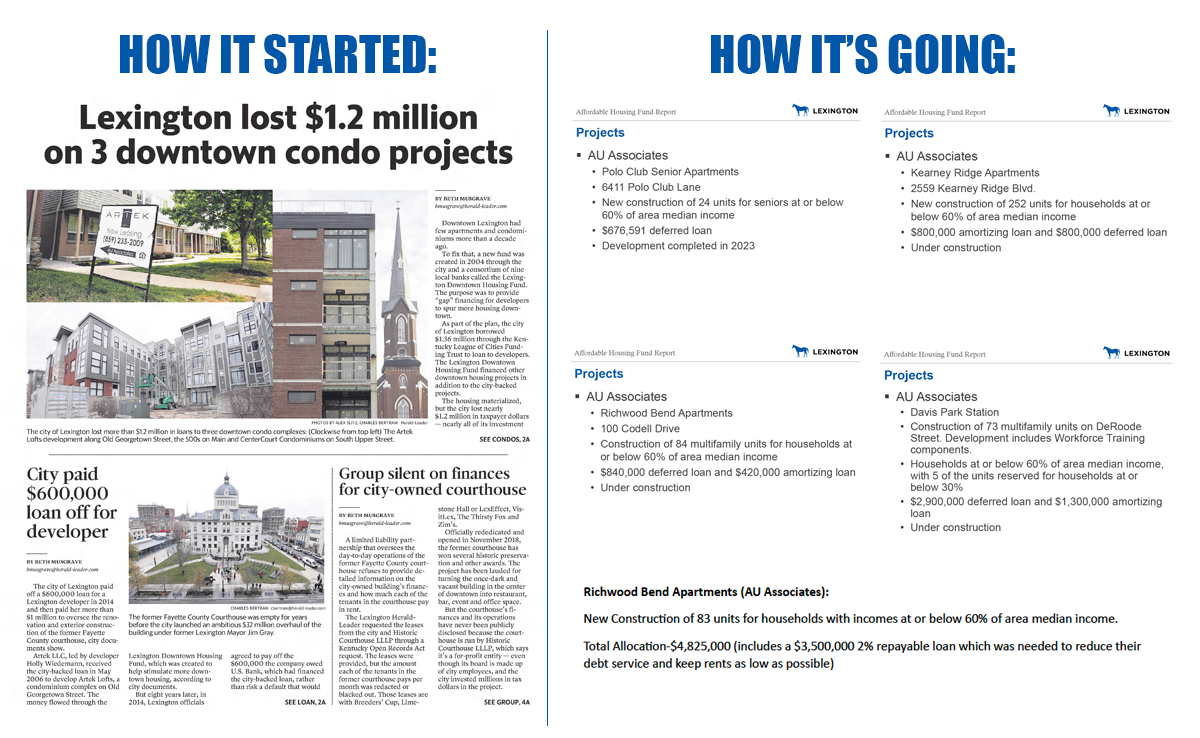

A report scheduled to be presented to the Urban County Council’s Social Services and Public Safety Committee on Tuesday, and made available online Friday, has revealed over $11 million in recent allocations to a firm whose owner’s past financial dealings with the City of Lexington have come under scrutiny.

AU Associates, founded by Holly Wiedemann, a Director at the Federal Reserve Bank of Cleveland, has been allocated over $11 million from Lexington’s Affordable Housing Fund for four projects in recent years, according to the city’s forthcoming Affordable Housing Fund report. Among these allocations is a low-interest 2% loan totaling $3.5 million, made from federal pandemic recovery funds granted to the city. Two of the four developments were completed in 2023, with the other two set to come online next year.

A Kentucky dynasty

Wiedemann, a prominent figure in the housing finance and development field, has been at the forefront of several area projects, including the redevelopment of the old courthouse in downtown Lexington and several subsidized Affordable Housing developments. Her firm’s approach focuses on preserving historical structures while providing housing in urban areas. (The “AU” in AU Associates, Inc. stands for “adaptive use”.) This approach has not only garnered professional recognition but also significant funding from public coffers. Wiedemann sold AU Associates to Johan Graham, her long-time development director, in 2021.

Writer Tom Eblen, who profiled Wiedemann in May 2022 for Kentucky Monthly, wrote that Wiedemann “comes from a long line of Kentucky entrepreneurs.”

“Her great-great-grandfather was George Wiedemann, a German immigrant who created Wiedemann beer in Newport in 1870. Her great-grandfather, J.D. Purcell, started Purcell’s, a leading Lexington department store in the mid-20th century.”

Writer Tom Eblen on Wiedemann’s entrepreneurial roots

According to Eblen, Wiedemann’s appreciation for historic buildings was cultivated from an early age, growing up near Lexington in an antebellum mansion with parts dating back to the late 1700s. Influenced by the mansion’s architectural integrity, she pursued landscape architecture at the University of Georgia, following a suggestion from her grandmother.

Her early career included working at Colonial Williamsburg and taking a break from studies to join author Wendell Berry and environmental lawyers in a successful campaign to prevent the flooding of the Red River Gorge by the Army Corps of Engineers. This endeavor, which culminated in a victory at the United States Supreme Court, saw her as the sole paid staff member of the Red River Gorge Legal Defense Fund, earning $2 an hour.

After business school, Wiedemann moved to Boston and took a role managing a large affordable-housing project, coinciding with the enactment of the Low-Income Housing Tax Credit Program in 1986. This timing provided her with vital experience in affordable-housing development. Following her father’s death in 1986, Wiedemann and her husband relocated to Kentucky, purchasing her childhood farm, The Hollys.

Past controversies involving unpaid loans, Old Courthouse renovation

In July 2019, Beth Musgrave of the Herald Leader reported a notable instance involving AU Associates, Wiedemann, and the City of Lexington. The city had previously paid off a $600,000 loan for Wiedemann’s Artek LLC in 2014 and then awarded AU Associates, also led by Wiedemann, over $1 million to oversee the renovation and exterior construction of the former Fayette County courthouse. This arrangement was made despite the firm’s prior financial obligations to the city being under question.

The 2014 financial deal involved the city settling a city-backed loan that AU Associates owed to U.S. Bank to avoid a default that could have negatively impacted the city’s credit rating. In return, Wiedemann’s firm agreed to pay the city $150,000 by April 2019, significantly less than the original loan amount. This agreement seemingly cleared the firm from the city’s policy that restricts business with entities owing back taxes or bad debts. According to another July 2019 Musgrave article, the city lost over $1 million on the project.

Following this agreement, AU Associates was contracted for the courthouse project, which involved a budget of up to $32 million. The firm’s role expanded as the project progressed, eventually overseeing the entire renovation and tenant acquisition process.

The financial intricacies of this arrangement, including the reduced loan repayment, the subsequent contract award, and the obfuscation of the project’s finances despite receiving millions of tax dollars, raised questions about the transparency and ethics of the city’s dealings with AU Associates.

Even though the city put $22 million, over half of the $32,710,890 renovation cost, into the Old Courthouse project, the entity that ultimately managed it, Historic Courthouse LLLP, claimed in 2019 that it was exempt from the Kentucky Open Records Act. Lawyers for the group refused to release full details of the organization’s finances, even to the Urban County Council.

I am on the airport board and we can get the leases for the tenants at the airport. We know how much the leases generate for the shops in the Lexington Civic Center. Why can’t we get the leases for the courthouse? We own the building.

Former At-Large Councilmember Richard Moloney in July 2019, questioning why the Old Courthouse project’s finances were not more transparent.

Courthouse connection

Jeff Fugate, currently serving as the Chair of the city’s Affordable Housing Board, held the influential position of president of the Downtown Development Authority from 2012 to 2017. In this capacity, Fugate was instrumental in the renovation of the former Fayette County Courthouse and other key urban development initiatives in Lexington, including the creation of the 21c Museum Hotel and the development of the Town Branch Commons park system.

Fugate’s dual roles underscore the interconnected nature of the development community in Lexington. The city’s development sector is characterized by a relatively small group of key players who often find themselves involved in multiple significant projects. This close-knit nature of the industry, while fostering a depth of experience and localized expertise, also raises considerations about the concentration of influence and the dynamics of project allocation within the city’s development landscape.

Jeff Fugate, current Chair of the Affordable Housing Board, also served as President of the Downtown Development Authority during AU Associates’ courthouse renovation.

(July 20, 2014 Lexington Herald-Leader/LFUCG)

AU Associates’ recent projects

In recent years, AU Associates has been approved for four development projects funded by Lexington’s Affordable Housing Fund, according to Tuesday’s forthcoming report. Two projects were completed in 2023, while the other two are under construction with 2024 completion dates. In total, the four projects will construct 433 Affordable Housing units.

- Richwood Bend Apartments (100 Codell Drive): This project involves the construction of 84 multifamily units specifically for households with incomes at or below 60% of the area median income. AU Associates received an $840,000 deferred loan and a $420,000 amortizing loan for this development, which is currently under construction. The total allocation of $4,825,000 also includes a $3,500,000 2% repayable loan which “was needed to reduce their debt service and keep rents as low as possible,” according to the report. The project also utilized Low Income Housing Tax Credits from Kentucky Housing Corporation.

- Davis Park Station (DeRoode Street): This development focuses on constructing 73 multifamily units, including a workforce training component. It caters to households at or below 60% of area median income, with 5 of these units reserved for households at or below 30%. The project also utilized Low Income Housing Tax Credits from Kentucky Housing Corporation.

- Polo Club Senior Apartments (6411 Polo Club Lane): Dedicated to senior citizens, this project saw the new construction of 24 units for seniors with incomes at or below 60% of the area median income. A $676,591 deferred loan was allocated to AU Associates for this development, which was completed in 2023. The project also utilized Low Income Housing Tax Credits from Kentucky Housing Corporation.

- Kearney Ridge Apartments (2559 Kearney Ridge Blvd.): This large-scale project involves the new construction of 252 units for households at or below 60% of area median income. The funding structure included an $800,000 amortizing loan and an equal deferred loan. This development opened in September 2023. The project also utilized Low Income Housing Tax Credits from Kentucky Housing Corporation.

A low-interest loan to a Federal Reserve Bank Director

Holly Wiedemann’s position as a Director at the Federal Reserve Bank of Cleveland, coupled with her connection to AU Associates, raises questions about the intersection of monetary policy, public funding, and private business interests.

During the COVID-19 pandemic, the Federal Reserve played a critical role in implementing monetary policies, including measures that increased the money supply in conjunction with a $4.6 trillion injection of federal government spending into the economy. These actions, while necessary to mitigate the economic impact of the pandemic, led to increased inflation. In response to the resulting inflation, the Fed began raising interest rates in 2022.

For a typical borrower, current mortgage rates are around 7.5%, according to the Federal Reserve. However, the $3.5 million loan obtained by AU Associates from the Affordable Housing Fund, at a 2% rate significantly below the prevailing market rates, diverges significantly from the typical consumer’s outcome.

The Affordable Housing Fund Report says the low-interest repayable loan for construction of 83 units on Codell Drive, “was needed to reduce [AU Associates’] debt service and keep rents as low as possible.” Although the project presents a clear public advantage by increasing the supply of affordable housing, it concurrently channels public funds towards a well-connected landlord, resulting in private profit.

This situation raises concerns about access to and the distribution of public funds, especially when individuals involved have significant roles in institutions like the Federal Reserve, which influences monetary policy and, by extension, interest rates. The fact that Wiedemann, a Director at the Federal Reserve, is connected to a company receiving a low-interest loan from a fund partly replenished by federal COVID-19 recovery money, adds another layer to the issue. It suggests a potential advantage in accessing federal stimulus funds ‘straight off the printing press,’ thereby potentially bypassing the broader economic impacts of inflation and higher interest rates that the general public faces.

Ultimately, the story of AU Associates underscores the importance of scrutinizing and understanding the dynamics of public-private partnerships. It serves as a reminder of the need for ongoing dialogue and oversight to ensure that such collaborations are conducted in a manner that upholds public trust while also fostering community development and progress.

Recommended Posts

Kamala Harris needs a VP candidate. Could a governor fit the bill?

Fri, July 26, 2024

After cyber-attack on Jefferson County Clerk, Fayette counterpart discusses precautions

Fri, July 26, 2024

An eastern Kentucky animal shelter is swelling this summer

Fri, July 26, 2024